2024 Outlook: Rebuilding trust in digital assets

2024 is shaping up to be a groundbreaking year for digital assets. After a rollercoaster digital asset winter, we're seeing a new dawn where scepticism turns into keen interest where the thirst for real world assets and blockchain come together and where traditional investors access these investments via various implementations of blockchain to create a new ecosystem for finance.

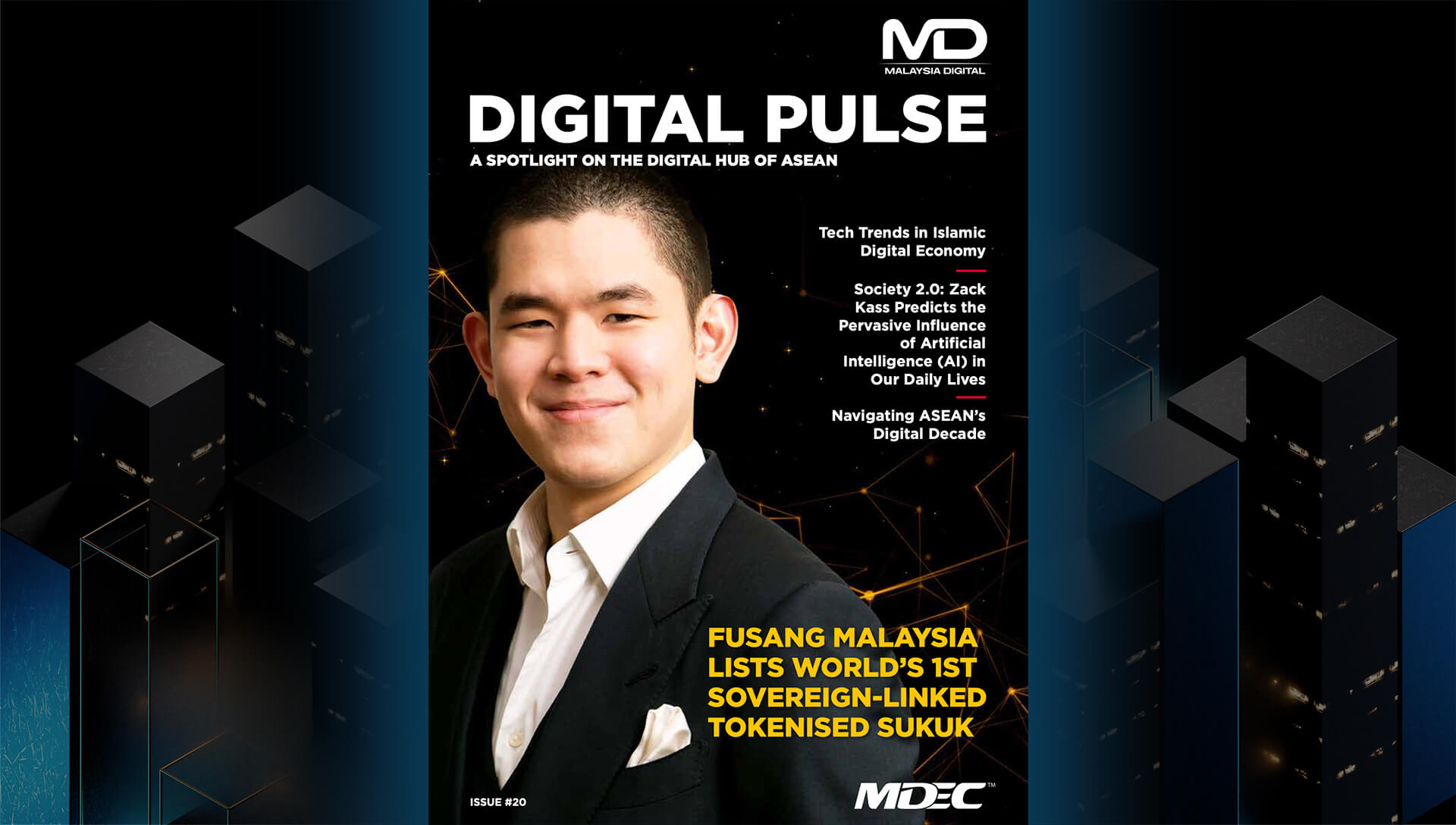

The year ahead promises to be a watershed moment for tokenised assets, institutional adoption of blockchain for real business purposes and the increasing access to private and alternative investments packaged in digital form. In this article, we talk with former regulator and Fusang President and Co Founder Kelvin Ung about the fundamental differences between tokenised assets and crypto, and how a legitimately licensed digital stock exchange can provide broker dealers and banks safe access for digital assets for both tokenised real world assets and crypto currencies.

What exactly is a licensed digital stock exchange?

First off, not all digital asset exchanges are the same. There are exchanges that are licensed and there are exchanges that may still be unlicensed. While both could provide a marketplace for digital assets, market participants are provided an entirely different customer experience with each.

Unlicensed centralised exchanges often have more in common with an OTC dealer network where there is opaqueness as to how conflicts of interest are managed when handling client order flow pre-trade, at executions point, and post trade settlement. The opaqueness tends to happen more with crypto assets due to less mature regulation than securities.

Centralised and licensed exchanges on the other hand are set up to provide a fair and orderly marketplace where the rules of engagement with their clients are first governed by the exchange (which is licensed as the front line regulator) and is ultimately supervised by their local regulator.

So it is clear that not all exchanges are created equal and are subject to the regulatory framework they operate under, if they have one at all, and as such they may have varying governance frameworks with respect to how the operator distributes and provides access to digital assets for their customers. In light of this, regulated financial intermediaries should always ask, “Is this a reputable exchange that my regulator would be convinced that our investors should be transacting with or not?”

Given securities regulation is much more mature than crypto regulation, mainstream financial intermediaries seeking to access digital assets will find it far easier to comply with their own regulatory and compliance requirements by accessing digital assets as securities via a regulated digital stock exchange.

What should brokers expect from interoperating with a regulated stock exchange?

Licensed stock exchanges are meant to operate in a predictable way where all market participants are treated in a fair and orderly manner, and the rules by which participants transact are clear and transparent.

On reflection, the turbulence that we have seen in the digital asset exchange community, has been particularly centred around those that were not regulated as a form of exchange, market operator, or alternative trading system. The problems in these unlicensed marketplaces are simply re-living problems in securities markets that were stamped out of electronic trading over 20 years ago.

Institutional brokers and banks expect to interoperate with digital assets in a compliant and orderly manner as set out by their licencing requirements, risk management frameworks and fiduciary obligations towards their own clients. Hence, access to digital assets for both tokenised securities and crypto currencies is best accessed via regulated providers. This goes beyond simply complying with KYC and AML checks and leans more towards regulated market govenances, a high regulatory bar that all licensed securities brokers and banks expect.

Fusang Exchange is a platform built with this horizon in mind. We are taking measured, careful steps to ensure that we create a fair and orderly marketplace for all market participants whilst bringing the benefits of digital assets to banks and brokers.

Meanwhile, we expect that regulators will begin to differentiate between digital securities and cryptocurrencies more systematically as each regulator clarifies its position within their jurisdiction, creating the possibility of a multilateral agreement on definitions, processes and compliance. As this happens, I believe that digital asset adoption will accelerate at a great pace for regulated institutions.

Are all digital assets the same?

When discussing digital assets there tends to be confusion between cryptocurrencies and digital securities – and sometimes this confusion even extends to compliance teams, financial intermediaries, and even regulators. As regulatory clarity on digital assets matures in each jurisdiction around the world, there is a clear distinction materialising in which assets that mimic traditional investments characteristics should fall into the digital securities category and thus be regulated under securities regulation. Crypto tokens on open blockchains lacking a clear legal relationship to an underlying asset tend to have little legal recourse in the event of fraud or theft once the assets are transferred on the blockchain.

What is the general rule on digital securities vs. crypto assets, why should regulated intermediaries care?

Digital securities provide a legal link between a digital asset representation and the actual underlying asset, which readily provides recourse in case of fraud – unlike most crypto assets, which lack an inherent value anchor aside from prevailing market prices. With tokenised assets, there is clarity and certainty with regards to what an investor is investing into, and there is legal recourse if you are defrauded.

Not all digital assets are created equal – some key differences between cryptocurrencies and digital securities

At Fusang, our view is that digital securities representing tokenised real world assets will be the dominant growth area for digital assets in 2024 and beyond, as traditional finance adoption increases exponentially in the coming years.

Bitcoin and ethereum have their place in the digital asset ecosystem, however the real adoption of digital will happen in the securities space as private markets open up through the power of digital and eventually via the evolution of programmable digital securities as we have seen in the crypto asset world.

Fusang provides access to digital securities via our innovative Fusang Depository Receipt (“FDR”) structure that ensures investors holding FDRs have clear and direct ownership of the asset, and have investor protection through a standardised third party custodian framework established for each digital asset. For crypto assets acquired through an open blockchain, investors may lack these protections, whereas investing in digital assets through our FDR framework is materially less risky than accessing digital assets directly.

At Fusang we have developed an ecosystem that ring fences regulated financial intermediaries, for which Fusang Exchange is the gatekeeper, limited to licensed market participants; ensuring the network only consists of regulated financial institutions from IOSCO-recognised jurisdictions. This in itself provides for surety on the part of the investor that all intermediaries involved adhere to a minimum global operational standard and accreditation, reducing the risks of interoperation with bad actors lacking in regulatory compliance standards that would be expected by market participants already operating as licensed intermediaries.

Fusang is a member-driven global network of regulated financial institutions that participate in an ecosystem designed to be fully-compliant for the issuance, cross-border trading, clearing, and settlement of private and alternative assets, powered by a standardised securities depository built for private and alternative assets.

Tokenised assets traded on regulated platforms have far lower counterparty risks – since all participants are identifiable and bound by KYC onboarding procedures by each intermediary. This is the primary use case for enabling access to private and alternative asset investments that eventually when fully digitised will be able to flow just like public securities between market participants on a global scale, at reduced cost and increased speed.

Brokers and banks can expect digital adoption for securities will change current business models, particularly with a T+0 market structure vs. the current T+2 settlement model of traditional finance. As market participants look to gain access to both digital securities and leading cryptocurrencies, it is imperative that they understand conducting business via a regulated digital exchange ensures investor protection and consistent outcomes, as opposed to scenarios where unlicensed operators and systemic flaws have allowed for blatant fraud and abuse, such as in the case of FTX.

What do banks and brokers’ compliance teams need to consider when identifying market operators that they can interoperate with?

As a start, these are some of the questions they should ask themselves:

- Is the market place operating as an exchange with transparent rules that are monitored by a regulatory body?

- Is the regulator recognised as an IOSCO recognised jurisdiction?

- For unlicensed exchanges, are they handling digital securities or primarily crypto assets?

- Is the exchange transparent as to who the market counterparties are?

- Are the counterparties regulated financial institutions, or unknown companies and individuals?

- Is the AML/KYC onboarding process aligned to the standard of my regulated business, or does the operation expose you to risks of non-compliance of your own licence conditions or governance practice?

Looking forward, is this the year of real world assets?

There is no doubt, digital securities and crypto assets will go toe to toe during 2024, driven by a market cycle where TradFi participants will actively adopt digital assets to provide access to meet client demand. Our expectation is that investors will finally gain access to both types of digital assets in a market structure that will be dominated by regulated market participants. Providing access to a wider range of institutional products via digital will drive liquidity into the market – and at Fusang, we are committed to providing access to existing financial institutions in a safe, standardised, transparent, and regulatory-compliant manner on our exchange.

Fusang’s first foray into tokenised real world assets has been by providing access to high quality sovereign linked assets via the Islamic Liquidity management corporate (“IILM”) tokenised Islamic bond, which global brokers can now access through Fusang’s order books, as opposed the previously opaque OTC markets of the existing market structure of the underlying instrument.

At Fusang we expect that the transition of finance will be led by digital securities – particularly in alternative investments – where we will see trillions of dollars invested over the next few years. Fusang’s fully regulated exchange architecture will enable banks and brokers a safe and clear path to access this asset class.

Regulated financial intermediaries may join the Fusang network from anywhere around the world, with simple and standardised access to private and public market investment products in a tokenised format – similar to how banks and brokers are used to working with traditional stock exchanges.

Fusang does this on a global scale, providing 24x7 trading to digital assets in a regulated financial ecosystem, enabling greater product access for institutions in a fair and orderly manner.